TS Banking Group’s President of Community Banking, Neil Stanley, recently emailed all of our employees the following article Ag Finance 101: How to Choose the Right Lender by Joel Harlow dated 5/27/13 from the AGWEB website. I feel the information in the article will be beneficial for many agriculture producers as they are interviewing and choosing a new lender.

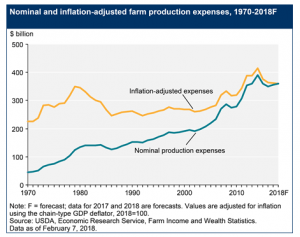

Joel’s comments in the article may be more relevant today than they were in 2013. I pulled the following charts from the USDA website. The data shows that the United States Net Farm Income peaked and set an all-time record high at $123.8 billion in 2013. USDA Net Farm Income forecast for 2017 is $63.8 billion (final numbers not yet available) and for 2018 is $59.5 billion (see chart below). United States Farm Production Expense decreases lagged the Net Cash Farm Income declines by approximately 18 months resulting in significant losses on average for farmers. There continues to be financial stress for farmers and ranchers across the United States with many producers seeking new financial lending institutions.

To read the article in its entirety, click here: Ag Finance 101: How to Choose the Right Lender.

About TS Ag Finance: TS Ag Finance is a DBA of TS Bank, located in Iowa serving the Midwest and beyond. The primary goal of TS Ag Finance is to partner with agricultural real estate originators, brokers and banks to help them retain and expand their ag client base and services offered. TS Ag Finance uses a network of national and regional team members with first-hand knowledge and years of experience in agricultural lending.