Success Stories

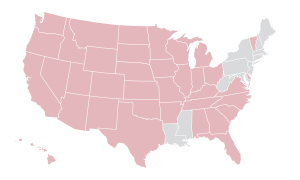

Closed Loan Reach

-

December 2023

TS Ag Finance closed a $1,404,000 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 40 acres of wine grape production as collateral and used the funds for the purchase of agricultural real estate.

-

December 2023

TS Ag Finance closed a $9,086,500 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 520 acres of avocado and miscellaneous fruits and nut production as collateral and used the funds for the refinance of agricultural real estate debt.

-

November 2023

TS Ag Finance closed a $3,700,000 loan with borrowers located in North Carolina. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 30-year term and 25-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 5 years (when the revolving feature matures). The borrowers pledged 127 acres of greenhouse and nursery facilities as collateral and used the funds for business purposes.

-

October 2023

TS Ag Finance closed a $490,000 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 20 acres of table grape production as collateral and used the funds for the purchase of agricultural real estate.

-

September 2023

TS Ag Finance closed a $2,780,000 loan with borrowers located in California. The borrowers chose the 10-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Ag Ignition Fund loan program. The borrowers pledged 150 acres of avocado production as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2023

TS Ag Finance closed a $1,425,000 loan with borrowers located in Minnesota. The borrowers chose the Ag Ignition RELOC with a 10-year draw period with interest only payments, 10-year term with a balloon payment at maturity, utilizing the Ag Ignition Fund loan program. The interest rate is fixed for the first and will adjust annually the remaining 5 years. The borrowers pledged 329 acres of corn and soybean production as collateral and used the funds for business purposes.

-

March 2023

TS Ag Finance closed a $2,275,000 loan with borrowers located in California. The borrowers chose the 3-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Triple R loan program. The borrowers pledged 1,324 acres of row crop and rangeland production as collateral and used the funds for the purchase of agricultural real estate.

-

February 2023

TS Ag Finance closed a $2,000,000 loan with borrowers located in California. The borrowers chose the 10-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Ag Ignition Fund loan program. The borrowers pledged 80 acres of tree fruits and walnut production as collateral and used the funds for the purchase of agricultural real estate.

-

February 2023

TS Ag Finance closed a $2,035,000 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 160 acres of almond production as collateral and used the funds for the refinance of agricultural real estate debt.

-

October 2022

TS Ag Finance closed a $1,320,000 loan with borrowers located in Iowa. The borrowers chose the 5-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 160 acres of corn and soybean production as collateral and used the funds for the purchase of agricultural real estate.

-

August 2022

TS Ag Finance closed a $2,331,038 loan with borrowers located in Texas. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 273 acres of ranchland as collateral and used the funds for the purchase of agricultural real estate.

-

July 2022

TS Ag Finance closed a $2,700,000 loan with borrowers located in North Carolina. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 25-year term and 20-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 5 years (when the revolving feature matures). The borrowers pledged 127 acres of greenhouse and nursery facilities as collateral and used the funds for business purposes.

-

June 2022

TS Ag Finance closed a $1,265,000 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 62 acres of almond production as collateral and used the funds for the purchase of agricultural real estate.

-

April 2022

TS Ag Finance closed a $1,800,000 loan with borrowers located in Washington. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Triple R loan program. The borrowers pledged 960 acres of irrigated row crop production as collateral and used the funds for the purchase of agricultural real estate.

-

March 2022

TS Ag Finance closed a $340,000 loan with borrowers located in Wyoming. The borrowers chose the Ag Equity RLOC with a 10-year draw period, 30-year term and 20-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 38 acres of tangerine and orange production as collateral and used the funds for business purposes.

-

March 2022

TS Ag Finance closed a $290,000 loan with borrowers located in Wyoming. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 30-year term and 25-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 45 acres of lemon and orange production as collateral and used the funds for business purposes.

-

March 2022

TS Ag Finance closed a $340,000 loan with borrowers located in Texas. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 45 acres of lemon and orange production as collateral and used the funds for the refinance of agricultural real estate debt.

-

March 2022

TS Ag Finance closed a $585,000 loan with borrowers located in Texas. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 20 acres of equestrian facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

March 2022

TS Ag Finance closed a $826,000 loan with borrowers located in Colorado. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 60 acres of ranchland as collateral and used the funds for the purchase of agriculture real estate.

-

March 2022

TS Ag Finance closed a $500,000 loan with borrowers located in Wyoming. The borrowers chose the Ag Equity RLOC with a 10-year draw period, 30-year term and 20-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 3,904 acres of ranchland as collateral and used the funds for business purposes.

-

March 2022

TS Ag Finance closed a $2,105,000 loan with borrowers located in Wyoming. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 3,904 acres of ranchland as collateral and used the funds for the refinance of agricultural real estate debt.

-

March 2022

TS Ag Finance closed a $1,250,000 loan with borrowers located in California. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 149 acres of wine grape production as collateral and used the funds for the refinance of agricultural real estate debt.

-

March 2022

TS Ag Finance closed a $568,000 loan with borrowers located in California. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 38 acres of orange production as collateral and used the funds for the purchase of agriculture real estate.

-

February 2022

TS Ag Finance closed a $304,500 loan with borrowers located in North Carolina. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 81 acres of Greenhouse facilities as collateral and used the funds for the purchase of agriculture real estate.

-

February 2021

TS Ag Finance closed a $1,850,000 loan with borrowers located in Texas. The borrowers chose the Ag Equity RLOC with a 10-year draw period, 30-year term and 20-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 470 acres of ranchland as collateral and used the funds for business purposes.

-

February 2022

TS Ag Finance closed a $361,000 loan with borrowers located in Texas. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 470 acres of ranchland as collateral and used the funds for the refinance of agricultural real estate debt.

-

February 2022

TS Ag Finance closed a $341,250 loan with borrowers located in California. The borrowers chose the 25-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 18 acres of raisin grape production as collateral and used the funds for the purchase of agriculture real estate.

-

February 2022

TS Ag Finance closed a $1,220,000 loan with borrowers located in Washington. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 85 acres of dairy and cropland production as collateral and used the funds for the refinance of agricultural real estate debt.

-

February 2022

TS Ag Finance closed a $1,908,200 loan with borrowers located in California. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 47 acres of equestrian facilities as collateral and used the funds for the purchase of agriculture real estate.

-

February 2022

TS Ag Finance closed a $1,605,000 loan with borrowers located in Wisconsin. The borrowers chose the 5-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 553 acres of dairy facilities and cropland as collateral and used the funds for the purchase of agriculture real estate.

-

February 2022

TS Ag Finance closed a $335,000 loan with borrowers located in Oregon. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 79 acres of row crop production and pastureland as collateral and used the funds for the refinance of agricultural real estate debt.

-

January 2022

TS Ag Finance closed a $332,000 loan with borrowers located in California. The borrowers chose the 15-year FIXED RESET interest rate product with a 20-year term and 20-year amortization, utilizing the Farmer Mac program. The borrowers pledged 24 acres of lemons and navel production as collateral and used the funds for the refinance of agricultural real estate debt.

-

January 2022

TS Ag Finance closed a $418,500 loan with borrowers located in Iowa. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 90 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate

-

December 2021

TS Ag Finance closed a $1,248,000 loan with borrowers located in California. The borrowers chose the 15-year FIXED interest rate product with a 15-year term and 15-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 160 acres of table grape production as collateral and used the funds for the refinance of agricultural real estate debt.

-

December 2021

TS Ag Finance closed a $663,000 loan with borrowers located in Iowa. The borrowers chose the 15-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 130 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $905,000 loan with borrowers located in Iowa. The borrowers chose the 15-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 160 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $905,000 loan with borrowers located in Iowa. The borrowers chose the 15-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 160 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $905,000 loan with borrowers located in Iowa. The borrowers chose the 15-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 160 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $280,000 loan with borrowers located in California. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 16 acres of cherry production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $300,000 loan with borrowers located in Iowa. The borrowers chose the 20-year FIXED interest rate product with a 20-year term and 20-year amortization, utilizing the Farmer Mac program. The borrowers pledged 1,359 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $1,500,000 loan with borrowers located in Washington. The borrowers chose the 25-year FIXED interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 1,359 acres of dryland crop production as collateral and used the funds for the purchase of agriculture real estate.

-

December 2021

TS Ag Finance closed a $1,540,000 loan with borrowers located in California. The borrowers chose the 10-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 34 acres of pastureland with future vineyard production plans as collateral and used the funds for the purchase of agriculture real estate.

-

November 2021

TS Ag Finance closed a $1,367,245 loan with borrowers located in California. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac program. The borrowers pledged 56 acres of tomato production as collateral and used the funds for the purchase of agriculture real estate.

-

November 2021

TS Ag Finance closed a $750,000 loan with borrowers located in California. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 40 acres of alfalfa and pomegranates as collateral and used the funds for the refinance of agricultural real estate debt.

-

November 2021

TS Ag Finance closed a $251,250 loan with borrowers located in Oregon. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 22 acres of pastureland as collateral and used the funds for the purchase of agriculture real estate.

-

November 2021

TS Ag Finance closed a $2,662,000 loan with borrowers located in California. The borrowers chose the 25-year FIXED interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac program. The borrowers pledged 301 acres of dairy production as collateral and used the funds for the refinance of agricultural real estate debt.

-

November 2021

TS Ag Finance closed a $289,500 loan with borrowers located in Florida. The borrowers chose the 7-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 44 acres of pastureland as collateral and used the funds for the purchase of agriculture real estate.

-

November 2021

TS Ag Finance closed a $261,250 loan with borrowers located in Missouri. The borrowers chose the 15-year FIXED interest rate product with a 15-year term and 15-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 22 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

October 2021

TS Ag Finance closed a $500,000 loan with borrowers located in North Carolina. The borrowers chose the 15-year FIXED interest rate product with a 15-year term and 15-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 44 acres of greenhouse production as collateral and used the funds for improvements on the agriculture real estate.

-

October 2021

TS Ag Finance closed a $190,000 loan with borrowers located in North Carolina. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 25-year term and 20-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 44 acres of greenhouse production as collateral and used the funds for business purposes.

-

October 2021

TS Ag Finance closed a $340,000 loan with borrowers located in Virginia. The borrowers chose the 20-year FIXED interest rate product with a 20-year term and 20-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 150 acres of raisin grape production as collateral and used the funds for the refinance of agricultural real estate debt.

-

October 2021

TS Ag Finance closed a $270,000 loan with borrowers located in Virginia. The borrowers chose the 15-year FIXED RESET interest rate product with a 20-year term and 20-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 150 acres of pastureland and timber as collateral and used the funds for the refinance of agricultural real estate debt.

-

October 2021

TS Ag Finance closed a $500,000 loan with borrowers located in California. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 29 acres of walnut production as collateral and used the funds for the purchase of agriculture real estate.

-

October 2021

TS Ag Finance closed a $750,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 30-year term and 25-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 5 years (when the revolving feature matures). The borrowers pledged 47 acres of walnut production as collateral and used the funds for business purposes.

-

October 2021

TS Ag Finance closed a $765,000 loan with borrowers located in Arizona. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 19 acres of equestrian facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

October 2021

TS Ag Finance closed a $500,000 loan with borrowers located in Hawaii. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R program. The borrowers pledged 18 acres of pastureland as collateral and used the funds for the refinance of agricultural real estate debt.

-

September 2021

TS Ag Finance closed a $1,200,000 loan with borrowers located in California. The borrowers chose the 5-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 41 acres of dairy production as collateral and used the funds for the refinance of agricultural real estate debt.

-

September 2021

TS Ag Finance closed a $936,000 loan with borrowers located in Iowa. The borrowers chose the 25-year FIXED interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 392 acres of corn and soybean production as collateral and used the funds for the purchase of agriculture real estate.

-

September 2021

TS Ag Finance closed a $980,000 loan with borrowers located in Texas. The borrowers chose the 10-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 61 acres of hunting and recreation land as collateral and used the funds for the refinance of agricultural real estate debt.

-

September 2021

TS Ag Finance closed a $400,000 loan with borrowers located in Texas. The borrowers chose the 10-year FIXED RESET interest rate product with a 15-year term and 15-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 60 acres of greenhouse production as collateral and used the funds for improvements on the agriculture real estate.

-

September 2021

TS Ag Finance closed a $402,500 loan with borrowers located in Texas. The borrowers chose the Ag Equity RLOC with a 10-year draw period, 25-year term and 15-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 60 acres of greenhouse production as collateral and used the funds for business purposes.

-

September 2021

TS Ag Finance closed a $441,000 loan with borrowers located in Oregon. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 38 acres of filbert nut production as collateral and used the funds for the purchase of agriculture real estate.

-

September 2021

TS Ag Finance closed a $2,025,000 loan with borrowers located in Arizona. The borrowers chose the 15-year FIXED RESET interest rate product with a 25-year term and 25-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 38 acres of almond production as collateral and used the funds for the purchase of agriculture real estate.

-

August 2021

TS Ag Finance closed a $350,000 loan with borrowers located in California. The borrowers chose the 10-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 49 acres of almond production as collateral and used the funds for the refinance of agricultural real estate debt.

-

August 2021

TS Ag Finance closed a $1,650,000 loan with borrowers located in Texas. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 87 acres of orange production as collateral and used the funds for the refinance of agricultural real estate debt.

-

August 2021

TS Ag Finance closed a $500,000 loan with borrowers located in Iowa. The borrowers chose the 10-year FIXED interest rate product with a 10-year term and 10-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 133 acres of corn and soybean production as collateral and used the funds for purchase of agriculture real estate.

-

August 2021

TS Ag Finance closed a $1,027,000 loan with borrowers located in California. The borrowers chose the 10-year FIXED RESET interest rate product with a 20-year term and 20-year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 49 acres of almond production as collateral and used the funds for purchase of agriculture real estate.

-

July 2021

TS Ag Finance closed a $500,000 loan with borrowers located in Texas. The borrowers chose the Ag Equity RLOC with a 5-year draw period, 30-year term and 25-year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 5 years (when the revolving feature matures). The borrowers pledged 283 acres of pasture as collateral and used the funds for business purposes.

-

July 2021

TS Ag Finance closed a $218,000 loan with borrowers located in Texas. The borrowers chose the 10-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 283 acres of pasture as collateral and used the funds for the refinance of agricultural real estate debt.

-

July 2021

TS Ag Finance closed a $1,390,000 loan with borrowers located in Texas. The borrowers chose the 15-year FIXED RESET interest rate product with a 30-year term and 30-year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 220 acres of ranchland as collateral and used the funds for the purchase of agricultural real estate.

-

July 2021

TS Ag Finance closed a $950,000 loan with borrowers located in Missouri. The borrowers chose the 30-year FIXED interest rate product with a 30-year term and 30-year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 189 acres of cropland and hay production as collateral and used the funds for refinance of agriculture real estate debt.

-

July 2021

TS Ag Finance closed a $400,000 loan with borrowers located in California. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 24 acres of citrus production as collateral and used the funds for the purchase of agricultural real estate.

-

July 2021

TS Ag Finance closed a $1,245,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 60 acres of walnut production as collateral and used the funds for the purchase of agricultural real estate.

-

July 2021

TS Ag Finance closed a $1,500,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 654 acres of dairy facilities and wine grapes as collateral and used the funds for business purposes.

-

July 2021

TS Ag Finance closed a $8,070,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 654 acres of dairy facilities and wine grapes as collateral and used the funds for the refinance of agricultural real estate debt.

-

July 2021

TS Ag Finance closed a $800,000 loan with borrowers located in Texas. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 2,115 acres of ranch land/recreation as collateral and used the funds for the refinance of agricultural real estate debt.

-

July 2021

TS Ag Finance closed a $192,500 loan with borrowers located in Florida. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 22 acres of hay production as collateral and used the funds for the purchase of agricultural real estate.

-

June 2021

TS Ag Finance closed a $693,000 loan with borrowers located in Georgia. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 35 acres of equestrian facilities as collateral and used the funds for the purchase of agricultural real estate.

-

June 2021

TS Ag Finance closed a $674,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 39 acres of walnut production as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $710,370 loan with borrowers located in Minnesota. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 292 acres of corn and soybean production as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $1,200,000 loan with borrowers located in Texas. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 324 acres of ranch land as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $1,460,000 loan with borrowers located in Minnesota. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 468 acres of corn and soybean production as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $1,265,500 loan with borrowers located in Washington. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 102 acres of ranch land as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $621,000 loan with borrowers located in Washington. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 160 acres of corn and alfalfa production as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $500,000 loan with borrowers located in Oregon. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 334 acres of ranch land as collateral and used the funds for business purposes.

-

June 2021

TS Ag Finance closed a $1,555,000 loan with borrowers located in Oregon. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 334 acres of ranchland as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $950,000 loan with borrowers located in New Mexico. The borrowers chose the 10 year fixed reset interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 49 acres of ranchland as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $1,500,000 loan with borrowers located in North Carolina. The borrowers chose the Ag Equity RLOC with a five year draw period, 25 year term and 20 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 113 acres of greenhouse facilities as collateral and used the funds for business purposes.

-

June 2021

TS Ag Finance closed a $4,340,000 loan with borrowers located in North Carolina. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 113 acres of greenhouse facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $1,938,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 25 acres of equestrian facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

June 2021

TS Ag Finance closed a $315,000 loan with borrowers located in Iowa. The borrowers chose the 10 year fixed interest rate product with a 10 year term and 10 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 111 acres of corn and bean production as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $305,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 40 acres of almonds as collateral and used the funds for refinance of agriculture real estate debt.

-

May 2021

TS Ag Finance closed a $278,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 38 acres of oranges and lemons as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $744,000 loan with borrowers located in Washington. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 80 acres of dairy facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $1,885,000 loan with borrowers located in Georgia. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 805 acres of pasture and timber as collateral and used the funds for refinance of agriculture real estate debt.

-

May 2021

TS Ag Finance closed a $945,000 loan with borrowers located in Oregon. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 138 acres of hay production and hunting recreation as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $720,000 loan with borrowers located in California. The borrowers chose the 20 year fixed interest rate product with a 20 year term and 20 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 20 acres of almonds as collateral and used the funds for refinance of agriculture real estate debt.

-

May 2021

TS Ag Finance closed a $462,500 loan with borrowers located in Arizona. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 226 acres of ranchland as collateral and used the funds for purchase of agriculture real estate.

-

May 2021

TS Ag Finance closed a $1,032,500 loan with borrowers located in Florida. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 10 acres of equestrian facilities as collateral and used the funds for purchase of agriculture real estate.

-

May 2021

TS Ag Finance closed a $70,000 loan with borrowers located in Oregon. The borrowers chose the Ag Equity RLOC with a 10 year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 42 acres of timber production as collateral and used the funds for business purposes.

-

May 2021

TS Ag Finance closed a $427,000 loan with borrowers located in Oregon. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 42 acres of timber production as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $421,000 loan with borrowers located in Montana. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 200 acres of rangeland as collateral and used the funds for purchase of agriculture real estate.

-

May 2021

TS Ag Finance closed a $1,500,000 loan with borrowers located in Indiana. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 1,970 acres of wheat and hay production as collateral and used the funds for the refinance of agricultural real estate debt.

-

May 2021

TS Ag Finance closed a $1,444,800 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 38 acres of walnuts and grapes/wine production as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $966,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 38 acres of walnuts and grapes/wine production as collateral and used the funds for the purchase of agricultural real estate.

-

April 2021

TS Ag Finance closed a $875,000 loan with borrowers located in Oregon. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 328 acres of grapes/wine production as collateral and used the funds for business purposes.

-

April 2021

TS Ag Finance closed a $4,000,000 loan with borrowers located in Oregon. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 328 acres of grapes/wine production as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $502,800 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 10 acres of oranges as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $1,000,000 loan with borrowers located in Washington. The borrowers chose the 15 year fixed reset interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 200 acres of wheat and fescue production as collateral and used the funds for the purchase of agricultural real estate.

-

April 2021

TS Ag Finance closed a $758,715 loan with borrowers located in Arizona. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 240 acres of greenhouse facilities as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $540,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 30 acres of oranges and tangerines production as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $510,000 loan with borrowers located in Ohio. The borrowers chose the Ag Equity RLOC with a five year draw period, 25 year term and 20 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 101 acres of greenhouse facilities as collateral and used the funds for business purposes.

-

April 2021

TS Ag Finance closed a $8,525,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 792 acres of blueberries and fescue production as collateral and used the funds for the refinance of agricultural real estate debt.

-

April 2021

TS Ag Finance closed a $350,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 15 year term and 15 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 109 acres of pistachio production as collateral and used the funds for the purchase of agriculture real estate.

-

April 2021

TS Ag Finance closed a $500,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 20 acres of irrigated cropland as collateral and used the funds for refinancing exiting real estate debt.

-

April 2021

TS Ag Finance closed a $300,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 12 acres of wheat production as collateral and used the funds for the purchase of agricultural real estate.

-

April 2021

TS Ag Finance closed a $1,850,000 loan with borrowers located in California. The borrowers chose the 25 year fixed interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 103 acres of vineyard and pasture as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $225,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 118 acres of almonds as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $575,250 loan with borrowers located in California. The borrowers chose the 25 year FIXED interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 103 acres of vineyard and pasture as collateral and used the funds for refinancing exiting real estate debt.

-

March 2021

TS Ag Finance closed a $300,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 12 acres of wheat as collateral and used the funds for the purchase of agricultural real estate.

-

February 2021

TS Ag Finance closed a $1,375,000 loan with borrowers located in Washington. The borrowers chose the 25 year fixed interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 271 acres of alfalfa as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $6,000,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 206 acres of vegetables as collateral and used the funds for future business expenses.

-

February 2021

TS Ag Finance closed a $2,800,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 206 acres of vegetables as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $6,000,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 1,160 acres of pistachios and walnuts as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $712,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 25 acres of solar farm as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $988,000 loan with borrowers located in Texas. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 599 acres of row-crop farmland and native pasture as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $7,064,000 loan with borrowers located in Iowa. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 1,665 acres of corn, soybean and pastureland as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $1,289,090 loan with borrowers located in Indiana. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 512 acres of corn and soybeans as collateral and used the funds for refinancing exiting real estate debt.

-

February 2021

TS Ag Finance closed a $625,000 loan with borrowers located in Alabama. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged five acres of timber as collateral and used the funds for refinancing exiting real estate debt.

-

January 2021

TS Ag Finance closed a $1,650,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 1,050 acres of equestrian facilities as collateral and used the funds for refinancing exiting real estate debt.

-

January 2021

TS Ag Finance closed a $3,600,000 loan with borrowers located in Washington. The borrowers chose the 10 year fixed reset interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 435 acres of dairy facilities as collateral and used the funds for refinancing exiting real estate debt.

-

January 2021

TS Ag Finance closed a $620,000 loan with borrowers located in Texas. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 190 acres of ranch and hay ground as collateral and used the funds for purchase of agriculture real estate.

-

January 2021

TS Ag Finance closed a $1,155,000 loan with borrowers located in Colorado. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 120 acres of ranch and hay ground as collateral and used the funds for purchase of agriculture real estate.

-

January 2021

TS Ag Finance closed a $66,150 loan with borrowers located in Missouri. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 53 acres of equestrian facilities as collateral and used the funds for the purchase of agriculture real estate.

-

January 2021

TS Ag Finance closed a $550,000 loan with borrowers located in Oregon. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 33 acres of hay ground as collateral and used the funds for the purchase of agriculture real estate.

-

January 2021

TS Ag Finance closed a $1,715,000 loan with borrowers located in Florida. The borrowers chose the Ag Equity RLOC with a 10 year draw period, 30 year term and 20 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after 10 years (when the revolving feature matures). The borrowers pledged 35 acres of equestrian facilities as collateral and used the funds for refinancing exiting real estate debt.

-

January 2021

TS Ag Finance closed a $1,285,000 loan with borrowers located in Florida. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 35 acres of equestrian facilities as collateral and used the funds for refinancing exiting real estate debt.

-

January 2021

TS Ag Finance closed a $321,425 loan with borrowers located in Michigan. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 136 acres of corn and soybeans as collateral and used the funds for refinancing exiting real estate debt.

-

December 2020

TS Ag Finance closed a $600,000 loan with borrowers located in Texas. The borrowers chose the 10 year fixed reset interest rate product with a 15 year term and 15 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 60 acres of greenhouse facilities as collateral and used the funds for the refinance of agriculture real estate debt.

-

December 2020

TS Ag Finance closed a $210,000 loan with borrowers located in Oregon. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged six acres of timber as collateral and used the funds for the purchase of real estate.

-

December 2020

TS Ag Finance closed a $1,000,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 118 acres of almonds as collateral and used the funds for the refinance of agriculture real estate debt.

-

December 2020

TS Ag Finance closed a $1,162,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 79 acres of oranges as collateral and used the funds for the purchase of real estate.

-

December 2020

TS Ag Finance closed a $130,000 loan with borrowers located in Iowa. The borrowers chose the 20 year fixed interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 24 acres of corn and soybeans as collateral and used the funds for the purchase of real estate.

-

December 2020

TS Ag Finance closed a $170,000 loan with borrowers located in Iowa. The borrowers chose the five year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 96 acres of corn and soybeans as collateral and used the funds for the refinance of real estate debt.

-

December 2020

TS Ag Finance closed a $655,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 76 acres of dairy facilities and hay as collateral and used the funds for business operating needs.

-

December 2020

TS Ag Finance closed a $1,050,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 77 acres of dairy facilities and hay as collateral and used the funds for the refinance of real estate debt.

-

December 2020

TS Ag Finance closed a $296,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 17 acres of oranges as collateral and used the funds for the purchase of agriculture real estate.

-

November 2020

TS Ag Finance closed a $498,000 loan with borrowers located in Oklahoma. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 60 acres of cattle ranchland and rural residence as collateral and used the funds for the purchase of real estate.

-

November 2020

TS Ag Finance closed a $205,650 loan with borrowers located in Kansas. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 60 acres of corn and soybeans as collateral and used the funds for the purchase of agriculture real estate.

-

November 2020

TS Ag Finance closed a $2,800,000 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 166 acres of oranges and lemons as collateral and used the funds for the purchase of real estate.

-

November 2020

TS Ag Finance closed a $979,000 loan with borrowers located in New Mexico. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 14,481 acres of cattle ranch land as collateral and used the funds for business operating needs.

-

November 2020

TS Ag Finance closed a $750,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 76 acres of greenhouse facilities as collateral and used the funds for business operating needs.

-

October 2020

TS Ag Finance closed a $100,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 30 acres of almonds and rural residence as collateral and used the funds for real estate improvements.

-

October 2020

TS Ag Finance closed a $1,610,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 80 acres of avocados and lemons as collateral and used the funds for the purchase of real estate.

-

October 2020

TS Ag Finance closed a $539,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 37 acres of organic almonds as collateral and used the funds for the purchase of real estate.

-

October 2020

TS Ag Finance closed a $1,522,890 loan with borrowers located in Idaho. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 3,731 acres of dryland pasture as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $485,000 loan with borrowers located in Iowa. The borrowers chose the 15 year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 228 acres of corn and soybeans as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $500,000 loan with borrowers located in Texas. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 583 acres of native pastureland as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $700,000 loan with borrowers located in Missouri. The borrowers chose the five year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 378 acres of corn and soybeans as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $300,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 40 acres of almonds as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $475,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 49 acres of almonds as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $1,050,000 loan with borrowers located in Wyoming. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 3,375 acres of cattle ranch land as collateral and used the funds for refinancing exiting real estate debt.

-

October 2020

TS Ag Finance closed a $1,481,700 loan with borrowers located in Iowa. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program loan program. The borrowers pledged 377 acres of corn and soybeans as collateral and used the funds for refinancing exiting real estate debt.

-

September 2020

TS Ag Finance closed a $2,200,000 loan with borrowers located in Texas. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 1,358 acres of hunting and recreation real estate as collateral and used the funds for business operating needs.

-

September 2020

TS Ag Finance closed a $2,900,000 loan with borrowers located in Texas. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 1,358 acres of hunting and recreation real estate as collateral and used the funds for the refinance of existing farmland debt.

-

September 2020

TS Ag Finance closed a $5,400,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 307 acres of wine grapes as collateral and used the funds for the refinance of existing farmland debt.

-

September 2020

TS Ag Finance closed a $5,800,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 307 acres of wine grapes as collateral and used the funds for the refinance of existing farmland debt.

-

September 2020

TS Ag Finance closed a $5,700,000 loan with borrowers located in California. The borrowers chose the Ag Equity RLOC with a five year draw period, 30 year term and 25 year amortization, utilizing the Farmer Mac loan program. The interest rate can be converted to a fixed interest rate after five years (when the revolving feature matures). The borrowers pledged 307 acres of wine grapes as collateral and used the funds for business operating needs.

-

September 2020

TS Ag Finance closed a $250,000 loan with borrowers located in Oregon. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 102 acres of timberland and hay as collateral and used the funds for cash out purposes.

-

September 2020

TS Ag Finance closed a $235,000 loan with borrowers located in California. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged nine acres of almonds and personal residence as collateral and used the funds for the purchase of farmland.

-

September 2020

TS Ag Finance closed a $1,540,000 loan with borrowers located in California. The borrowers chose the 15 year fixed interest rate product with a 15 year term and 15 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 107 acres of almonds and grapes as collateral and used the funds for the refinance of exiting farmland debt.

-

September 2020

TS Ag Finance closed a $250,000 loan with borrowers located in Oregon. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 102 acres of timberland and hay as collateral and used the funds for cash out purposes.

-

September 2020

TS Ag Finance closed a $600,000 loan with borrowers located in Ohio. The borrowers chose the five year ARM interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 155 acres of corn and soybean as collateral and used the funds for the refinance of exiting farmland debt.

-

September 2020

TS Ag Finance closed a $7,250,000 loan with borrowers located in California. The borrowers chose the five year ARM interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 428 acres of almonds and prunes as collateral and used the funds for the refinance of exiting farmland debt.

-

September 2020

TS Ag Finance closed a $100,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 10 acres of raisin grapes as collateral and used the funds for cash out.

-

September 2020

TS Ag Finance closed a $310,000 loan with borrowers located in Iowa. The borrowers chose the 20 year fixed interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 157 acres of pastureland as collateral and used the funds for the refinance of existing farmland debt.

-

September 2020

TS Ag Finance closed a $660,000 loan with borrowers located in California. The borrowers chose the 15 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 24 acres of corn and alfalfa as collateral and used the funds for the refinance of existing farmland debt.

-

September 2020

TS Ag Finance closed a $570,000 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 17 acres of hay ground as collateral and used the funds for the purchase of farmland.

-

September 2020

TS Ag Finance closed an $8,298,000 loan with borrowers located in Texas. The borrowers chose the 10 year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 747 acres of hunting and recreation real estate as collateral and used the funds for property improvements.

-

August 2020

TS Ag Finance closed a $402,500 loan with borrowers located in Texas. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 48 acres of hay ground collateral and used the funds for purchase of farmland real estate.

-

August 2020

TS Ag Finance closed a $436,800 loan with borrowers located in Oregon. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 327 acres of forest reserve and recreation as collateral and for the purchase of farmland.

-

August 2020

TS Ag Finance closed a $500,000 loan with borrowers located in California. The borrowers chose the 10 year ARM interest rate product with a 20 year term and 20 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 30 acres of almonds as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $420,000 loan with borrowers located in California. The borrowers chose the five year ARM interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 30 acres of almonds as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $2,500,000 loan with borrowers located in California. The borrowers chose the 15 year ARM interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 379 acres of mandarins, irrigated land and rangeland as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $2,320,055 loan with borrowers located in Idaho. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 397 acres of corn, soybean and pastureland as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $684,210 loan with borrowers located in Missouri. The borrowers chose the 15 year fixed reset interest rate product with a 25 year term and 25 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 317 acres of potatoes and wheat as collateral and used the funds for purchase of farmland real estate.

-

August 2020

TS Ag Finance closed a $2,320,055 loan with borrowers located in Idaho. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 1,101 acres of irrigated cropland and dry pastureland as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $198,750 loan with borrowers located in California. The borrowers chose the 30 year fixed interest rate product with a 30 year term and 30 year amortization, utilizing the TS Ag Finance Triple R loan program. The borrowers pledged 80 acres of pastureland as collateral and used the funds for refinancing exiting real estate debt.

-

August 2020

TS Ag Finance closed a $4,600,000 loan with borrowers located in Texas. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 3,790 acres of corn and cotton lint as collateral and used the funds for purchase of farmland real estate.

-

July 2020

TS Ag Finance closed a $750,000 loan with borrowers located in California. The borrowers chose the five year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The borrowers pledged 10 acres of an acreage with apricots and table grapes and lemon production as collateral and used the funds for purchase of farmland real estate.

-

July 2020

TS Ag Finance closed a $1,155,325 loan with borrowers located in California. The borrowers chose the 25 year fixed interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The interest rate is fixed for 25 years with semi-annual payments. The borrowers pledged 75 acres of wine grape vineyard as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020

TS Ag Finance closed a $7,202,325 loan with borrowers located in California. The borrowers chose the five year ARM interest rate product with a 20 year term and 20 year amortization, utilizing the TS Ag Finance loan program. The interest rate is fixed for five years with semi-annual payments. The borrowers pledged 60 acres of raisin grapes and table grapes production as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020

TS Ag Finance closed a $1,312,500 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The interest rate is fixed for 10 years with monthly payments. The borrowers pledged five acres of an acreage with tangerine and lemon production as collateral and used the funds for purchase of farmland real estate.

-

July 2020

TS Ag Finance closed a $485,100 loan with borrowers located in California. The borrowers chose the 10 year fixed reset interest rate product with a 30 year term and 30 year amortization, utilizing the Farmer Mac loan program. The interest rate is fixed for 10 years with monthly payments. The borrowers pledged 103 acres of cattle ranch land as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020

TS Ag Finance closed a $500,000 loan with borrowers located in California. The borrowers chose the five year ARM interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The interest rate is fixed for five years with semi-annual payments. The borrowers pledged 37 acres of almond production as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020

TS Ag Finance closed a $600,000 loan with borrowers located in California. The borrowers chose the 10 year ARM interest rate product with a 25 year term and 25 year amortization, utilizing the TS Ag Finance Triple R loan program. The interest rate is fixed for 10 years with semi-annual payments. The borrowers pledged 30 acres of irrigated citrus production as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020

TS Ag Finance closed a $1,970,650 loan with borrowers located in Minnesota. The borrowers chose the five year fixed reset interest rate product with a 20 year term and 20 year amortization, utilizing the Farmer Mac loan program. The interest rate is fixed for five years with semi-annual payments. The borrowers pledged 543 acres of corn, swine and beef production facilities as collateral and used the funds for refinancing exiting real estate debt.

-

July 2020